Things about Copy Of Bankruptcy Discharge

Table of ContentsHow To Get Copy Of Bankruptcy Discharge Papers for BeginnersGetting My Obtaining Copy Of Bankruptcy Discharge Papers To WorkNot known Incorrect Statements About How Do I Get A Copy Of Bankruptcy Discharge Papers Fascination About Chapter 13 Discharge PapersHow To Obtain Bankruptcy Discharge Letter Things To Know Before You Buy

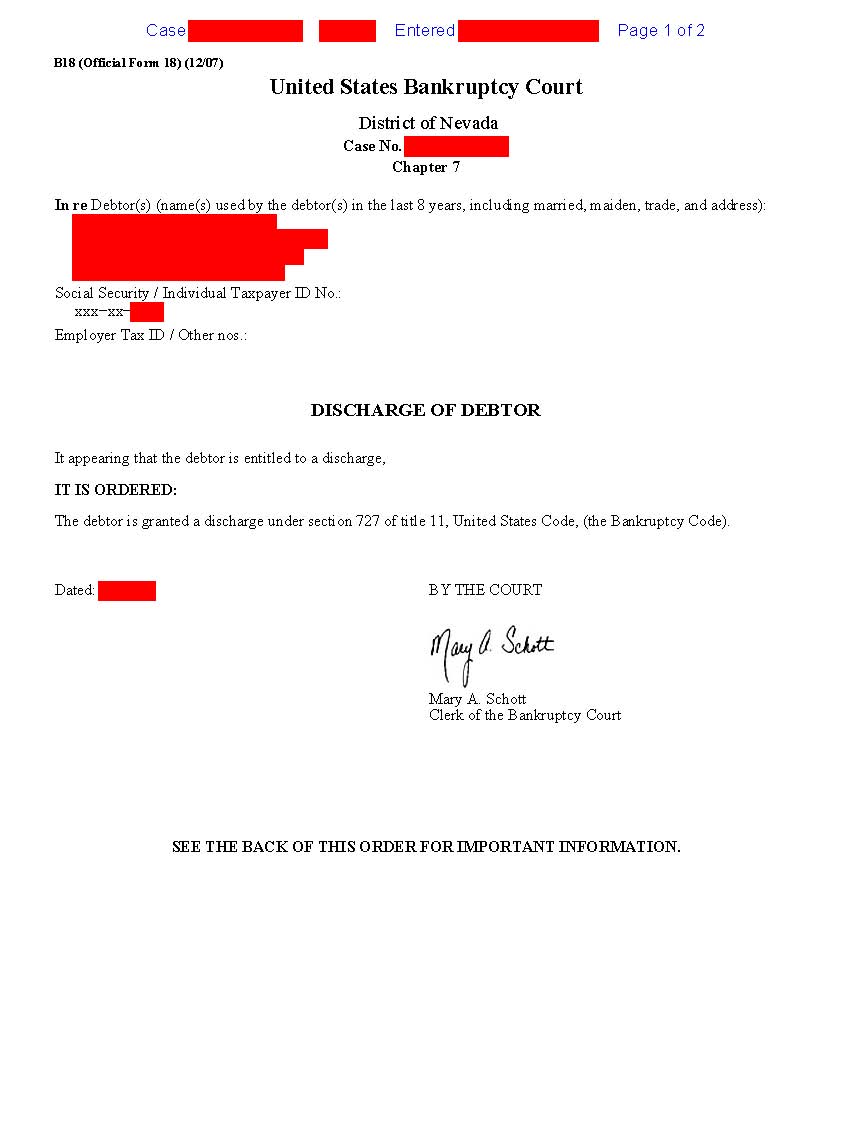

If you have actually misplaced your discharge records, you can still obtain a copy if you require it for any factor (https://b4nkrvptcydcp.jimdosite.com/). The starting point to examine when you require a copy of your bankruptcy discharge papers is with the Clerk of the Court where your instance was filed. Some courts will certainly permit you to look the document online completely free, while others bill a charge for searches.

There is generally a 10 cent per page access fee, but if you spend less than $15 each quarter of the year, the service is cost-free. You might need your instance number in order to browse the data source. It is not uncommon to see solutions online that provide to send you your discharge documents for a charge, often as high as $40 or even more.

Things about How To Get Copy Of Chapter 13 Discharge Papers

Attempt to avoid making use of such services and also get your records with the court staff or PACER to ensure you are not the sufferer of a scam (chapter 13 discharge papers). If you or a loved one is taking care of economic trouble, personal bankruptcy might be the answer so you can stop the lender calls and obtain back on your financial feet.

You can call us to prepare for a no responsibility examination or finish the simple type online.

It is necessary to keep your (or duplicates) in a refuge. Nevertheless, life takes place - and eventually in time, you might locate that you require this document, yet for one factor or another, you can't find it. Thankfully, there are several means you can set about replacing your duplicate of your authorities bankruptcy discharge.

There is a good chance that your lawyer will certainly still have a copy in his/her documents. If not, she or he may have the ability to access the Court's records digitally to publish the requested file. If you are worried concerning the record retrieval charges that your lawyer might bill for this service, ask initially! There's a likelihood that she or he will provide this service at on the house.

An Unbiased View of How To Get Copy Of Chapter 13 Discharge Papers

If it is greater than you want to pay, explore your various other options (see below) for obtaining a duplicate of the insolvency discharge. You can also request an insolvency discharge copy from the Staff's office located in the area as well as division where the insolvency situation was filed. The personal bankruptcy clerk will certainly bill a small cost for this service - obtaining copy of bankruptcy my explanation discharge papers.

You can locate the contact details for your Staff's workplace utilizing the state web links on the appropriate side of this page. Do you understand if your situation was digitally submitted with the personal bankruptcy court? If you submitted insolvency within the previous couple of years, there is a good possibility that it was, as well as for situations that are electronically filed, several of the files in case are kept online in the Court's PACER system.

Lots of people wish to obtain a duplicate of their bankruptcy discharge papers and various other bankruptcy paperwork, as well as there are numerous reasons. Maybe you need your full bankruptcy data for your documents, or you're looking to make an application for a brand-new job and call for a duplicate of your discharge papers. Usually a debtor will certainly require access to their bankruptcy documents to correct their credit score report after their situation is released.

It is very important to maintain a copy of your personal bankruptcy instance. Getting lawful advice from an seasoned bankruptcy lawyer is constantly essential. https://www.stories.qct.edu.au/profile/bankruptcydischargepapers8426/profile. Furthermore, they can review your instance file if questions occur after discharge. A personal bankruptcy attorney can aid you obtain personal bankruptcy documents for you documents and future usage.

The Main Principles Of Copy Of Bankruptcy Discharge

Having a duplicate of your personal bankruptcy documents can be extremely helpful in the event you obtain taken legal action against on a financial debt that must be discharged or require to contest a discharged financial debt with the credit rating coverage companies. A personal bankruptcy discharge order releases the debtor from individual liability for different kinds of financial debt (https://medium.com/@b4nkrvptcydcp/about).

A lender can not collect upon a financial obligation when the personal bankruptcy court discharges it in either a chapter 7 bankruptcy or a phase 13 insolvency. Because of this it is very important to keep a duplicate of your bankruptcy discharge. If you shed or misplaced your copy you need to try to obtain a duplicate of your personal bankruptcy documents.

Commonly when there are mistakes on a credit record. Credit reporting agency requirements typically need a copy of the discharge to make needed modifications. When the insolvency court concerns a discharge order for unsecured debt, most if not all credit card financial obligation, medical debt, and also various other unprotected types of financial debt can no longer be gathered upon by your lenders.

A debtor will want to maintain evidence of their insolvency declaring if a debt looks for to collect on an unsafe financial obligation after the bankruptcy is finished. Your personal bankruptcy records will include all of the financial institutions you owed money to.

The Ultimate Guide To Copy Of Chapter 7 Discharge Papers

Typical kinds of protected financial debt include a vehicle loan and also debts held by home loan business. The valid lien on residential properties that a bankruptcy filing has not cleared in this issue will certainly remain reliable after insolvency litigation. A protected lender has to apply the lien to recoup the ownership of the residential or commercial property subject to the lien.